FOR CONSUMERS everywhere

Build a powerful indisputable case with our services

We are committed to pushing the boundaries of what's possible.

15,000+ happy clients

FOR CONSUMERS everywhere

Build a powerful indisputable case with our services

We are committed to pushing the boundaries of what's possible.

15,000+ happy clients

Services

services designed to EMpower your journey with expertise and precession

Essential Insight Overview

OUR new industry stanard one page report to get started

Preliminary Compliance Check: Ensures compliance with regulations and requirements.

Securitization Review: Analyzes securitization processes for a comprehensive understanding.

Document Scan: Efficiently scans and organizes your documents.

SUPER TURN AROUND TIMES

Our Fast Turnaround service ensures that you receive your detailed report within 1-2 days of your request. We understand the importance of timely information, especially in dynamic situations. To further personalize the service and ensure you fully understand the contents and implications of your report and have your one-on-one schedule meeting with a special to go over and discuss your report in depth.

Essential Insight Overview

OUR new industry stanard one page report to get started

Preliminary Compliance Check: Ensures compliance with regulations and requirements.

Securitization Review: Analyzes securitization processes for a comprehensive understanding.

Document Scan: Efficiently scans and organizes your documents.

SUPER TURN AROUND TIMES

Our Fast Turnaround service ensures that you receive your detailed report within 1-2 days of your request. We understand the importance of timely information, especially in dynamic situations. To further personalize the service and ensure you fully understand the contents and implications of your report and have your one-on-one schedule meeting with a special to go over and discuss your report in depth.

precession pro report

Reveal Concerning Information

Detailed 6-7 Page Report

A comprehensive review of lending compliance rules and regulations, ensuring you understand the full scope of your financial interactions. With a focus on Transaction History Analysis, we identify discrepancies and potential issues in lenders' practices, particularly in areas such as Credit Cards, Mortgages, Student Loans, and Auto Loans. Each review is custom-tailored to meet your specific needs, providing a personalized approach to your financial analysis. Plus, enjoy a fast turnaround with detailed reports delivered within 2-4 days, allowing you to quickly take informed actions.

precession pro report

Reveal Concerning Information

Detailed 6-7 Page Report

A comprehensive review of lending compliance rules and regulations, ensuring you understand the full scope of your financial interactions. With a focus on Transaction History Analysis, we identify discrepancies and potential issues in lenders' practices, particularly in areas such as Credit Cards, Mortgages, Student Loans, and Auto Loans. Each review is custom-tailored to meet your specific needs, providing a personalized approach to your financial analysis. Plus, enjoy a fast turnaround with detailed reports delivered within 2-4 days, allowing you to quickly take informed actions.

ELite comprehensive Complete report (ECCO)

Ultimate Solution

This report is the pinnacle of our offerings, combining all aspects of our previous services into one all-encompassing package. We deliver a customized, tailored approach to each client’s unique needs, ensuring no detail is overlooked.

Thorough Examination: Our meticulous review process not only pinpoints vulnerabilities and potential risks but also addresses any specific concerns you might have, guaranteeing your complete satisfaction.

Services Offered: This complete report includes a detailed chain of title analysis, servicing agreement audits, proof of swap fraud, and securitization audit reviews, making it the most thorough option available.

Customized Package

Each report is specifically crafted to meet your particular requirements, whether you’re an individual, a small business, or a large corporation. We ensure that the analysis perfectly aligns with your objectives.

Delivery Time: Expect to receive your comprehensive report within 4-8 days, allowing you to make timely, informed decisions based on our findings.

ELite comprehensive Complete report (ECCO)

Ultimate Solution

This report is the pinnacle of our offerings, combining all aspects of our previous services into one all-encompassing package. We deliver a customized, tailored approach to each client’s unique needs, ensuring no detail is overlooked.

Thorough Examination: Our meticulous review process not only pinpoints vulnerabilities and potential risks but also addresses any specific concerns you might have, guaranteeing your complete satisfaction.

Services Offered: This complete report includes a detailed chain of title analysis, servicing agreement audits, proof of swap fraud, and securitization audit reviews, making it the most thorough option available.

Customized Package

Each report is specifically crafted to meet your particular requirements, whether you’re an individual, a small business, or a large corporation. We ensure that the analysis perfectly aligns with your objectives.

Delivery Time: Expect to receive your comprehensive report within 4-8 days, allowing you to make timely, informed decisions based on our findings.

Pro Se Litigants

OUR brand new improved ultimate legal suite

Description:

Unlock the full potential of legal support with our "Ultimate Legal Suite," a single, all-encompassing package that provides everything from basic legal document preparation to advanced litigation support and trial management. Tailored for both new and seasoned litigants, this suite is designed to handle every aspect of your legal journey with expertise and precision.

SERVICES

Legal Starter Kit: Jumpstart your legal proceedings with essentials like Complaint drafting, Summons, and Service of Process.

Advanced Litigation Support: Navigate the complexities of ongoing cases with our extensive motion drafting, discovery support, and trial preparation services.

Complete Legal Defense Package: Formulate a robust defense strategy with our comprehensive support in drafting responses, managing counterclaims, and strategic oppositions.

Appellate and High Court Services: Elevate your case with specialized appellate briefs and high court petitions, ensuring your arguments are heard at all judicial levels.

Pro Se Litigants

OUR brand new improved ultimate legal suite

Description:

Unlock the full potential of legal support with our "Ultimate Legal Suite," a single, all-encompassing package that provides everything from basic legal document preparation to advanced litigation support and trial management. Tailored for both new and seasoned litigants, this suite is designed to handle every aspect of your legal journey with expertise and precision.

SERVICES

Legal Starter Kit: Jumpstart your legal proceedings with essentials like Complaint drafting, Summons, and Service of Process.

Advanced Litigation Support: Navigate the complexities of ongoing cases with our extensive motion drafting, discovery support, and trial preparation services.

Complete Legal Defense Package: Formulate a robust defense strategy with our comprehensive support in drafting responses, managing counterclaims, and strategic oppositions.

Appellate and High Court Services: Elevate your case with specialized appellate briefs and high court petitions, ensuring your arguments are heard at all judicial levels.

Benefits

NAVIGATE YOUR LEGAL CHALLENGES

Gain Clarity

Navigate complex legalities with in-depth analysis and clear-cut compliance checks tailored to protect your consumer rights.

Gain Clarity

Navigate complex legalities with in-depth analysis and clear-cut compliance checks tailored to protect your consumer rights.

Maximize Legal Leverage

Harness full-scale legal support to turn the tide in your favor, from initial case preparations to high-stakes courtroom battles.

Maximize Legal Leverage

Harness full-scale legal support to turn the tide in your favor, from initial case preparations to high-stakes courtroom battles.

Custom-Fit Advocacy

Tailored litigation kits crafted with precision to meet the unique demands of your legal situation, ensuring a personalized defense strategy.

Custom-Fit Advocacy

Tailored litigation kits crafted with precision to meet the unique demands of your legal situation, ensuring a personalized defense strategy.

Case Study

Visualizing YOUr RIghts

Legal Strategy Innovation

Step into the world of legal mastery with our success stories—discover how our comprehensive reports and Pro Se Litigant support form a unique identity, empowering clients to take charge of their legal challenges.

Crystal-Clear Compliance & Analysis Reports

Litigation Support Mastery

Witness the transformation of our clients' legal processes with our customized service packages. From initial filings to complex trial preparation, we lay the groundwork for unparalleled legal advocacy.

Case Study

Visualizing YOUr RIghts

Legal Strategy Innovation

Step into the world of legal mastery with our success stories—discover how our comprehensive reports and Pro Se Litigant support form a unique identity, empowering clients to take charge of their legal challenges.

Crystal-Clear Compliance & Analysis Reports

Litigation Support Mastery

Witness the transformation of our clients' legal processes with our customized service packages. From initial filings to complex trial preparation, we lay the groundwork for unparalleled legal advocacy.

Testimonials

What our clients say about us

"XYZ transformed our business! Their creative strategies and approach drove significant online growth."

"XYZ transformed our business! Their creative strategies and approach drove significant online growth."

John Adams

John Adams

Marketing Director

"XYZ made our brand stand out. Innovative campaigns and data-driven strategies strengthened our identity. Highly recommended!"

"XYZ made our brand stand out. Innovative campaigns and data-driven strategies strengthened our identity. Highly recommended!"

Michael Anderson

Michael Anderson

Microsoft

"XYZ elevated our brand. Their data-driven approach and innovative campaigns gave us a competitive edge. Extremely satisfied!"

"XYZ elevated our brand. Their data-driven approach and innovative campaigns gave us a competitive edge. Extremely satisfied!"

Jane Does

Jane Does

Founder & CEO

"Working with XYZ was a pleasure. Their dedication and tailored solutions led to increased website traffic and conversions."

"Working with XYZ was a pleasure. Their dedication and tailored solutions led to increased website traffic and conversions."

Alex James

Alex James

Microsoft

"XYZ transformed our business! Their creative strategies and approach drove significant online growth."

John Adams

Marketing Director

"XYZ made our brand stand out. Innovative campaigns and data-driven strategies strengthened our identity. Highly recommended!"

Michael Anderson

Microsoft

"XYZ elevated our brand. Their data-driven approach and innovative campaigns gave us a competitive edge. Extremely satisfied!"

Jane Does

Founder & CEO

"Working with XYZ was a pleasure. Their dedication and tailored solutions led to increased website traffic and conversions."

Alex James

Microsoft

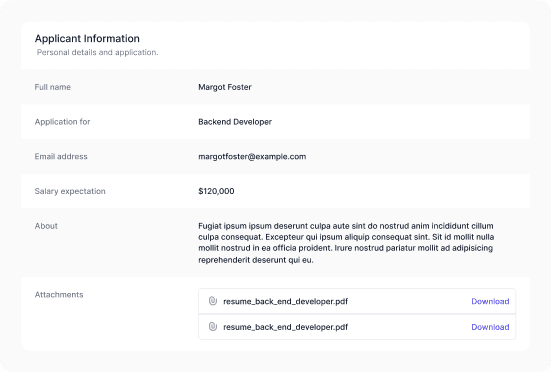

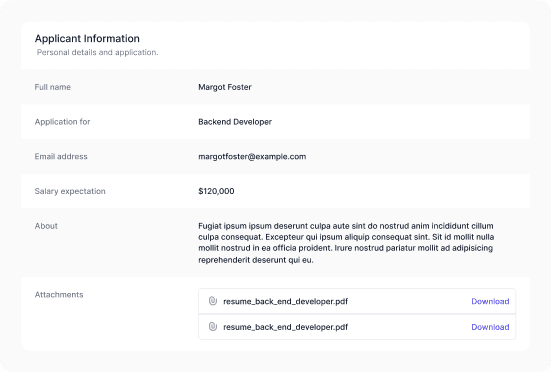

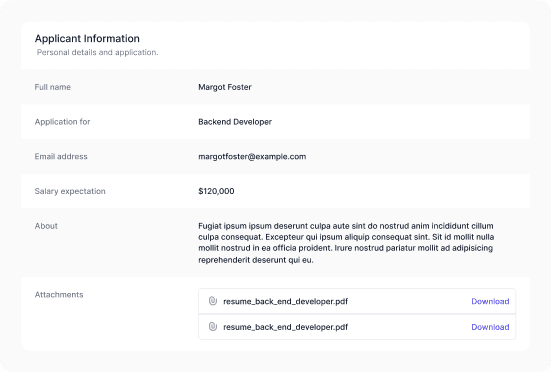

Order

Order your Essential Insight Overview today to book a one-on-one session.

FAq

Frequently asked questions

What is your pricing?

How are you different than other companies?

Do you offer a guarantee?

What is your pricing?

How are you different than other companies?

Do you offer a guarantee?

© Mont Limited 2023. All rights reserved.

© Mont Limited 2023. All rights reserved.

© Mont Limited 2023. All rights reserved.